Impressed with their financial expertise. They've made a significant difference in my investments, and their strategies have maximized my returns.

ONE STOP

Platform

Your trusted partner for personalized guidance and strategic solutions to achieve your financial goals with confidence.

An ecosystem that makes every bit of Personal Finance convenient and affordable.

At Finsify, we understand that managing wealth is a complex and dynamic process. We are dedicated to providing comprehensive and personalized financial solutions that help our clients achieve their unique financial goals. With a team of experienced professionals and a commitment to excellence, we are here to guide you on your journey towards financial success.

Our Philosophy: We believe that wealth management is not just about growing your assets; it's about creating a roadmap to financial security and peace of mind. Our philosophy is centered around three core principles:

Platform

Registered

Efficiency

Experience

Strategies

Review & Rebalancing

FAMILY Financial Advisor

Banks, AMC & Insurance company.

Whoever you are, at whatever stage you are in, there is an offering for you at Finsify. Get Started Now.

Pre-IPO investments involve buying shares of a company before it goes public and starts trading on the stock exchange.

Our Stocks Advisory service provides personalized recommendations and guidance to help you navigate the stock market with confidence.

Our Alternate Investments service opens the door to a variety of non-traditional asset classes, offering investors unique opportunities to diversify their portfolios and potentially enhance returns.

Investing in mutual funds is a smart option to grow your wealth. Mutual funds pool money from various investors to buy a diversified portfolio of stocks, bonds, and other securities.

Bonds are a vital component of any well-rounded investment strategy. They offer a stable source of income and are a solid addition to your financial portfolio.

Our Gold investment service allows you to purchase physical gold or invest in gold-backed financial products, providing you with exposure to the precious metal market.

Currency trading, also known as forex trading, involves buying and selling different currencies in the foreign exchange market.

Fixed Deposits (FDs) are a reliable and straightforward investment option. They provide a safe harbour for your hard-earned money, offering guaranteed returns with minimal risk. In this era of financial uncertainty, FDs stand as a beacon of stability.

Insurance is a shield that safeguards your assets and secures your future against unforeseen events. A comprehensive range of insurance services offers tailored ways to meet diverse needs.

Loans are financial instruments that allow individuals or businesses to borrow money from a lender, typically with the promise of repayment plus interest over a specified period.

Tax & Legal services encompass a range of offerings aimed at assisting individuals and businesses in fulfilling their tax obligations and navigating legal complexities.

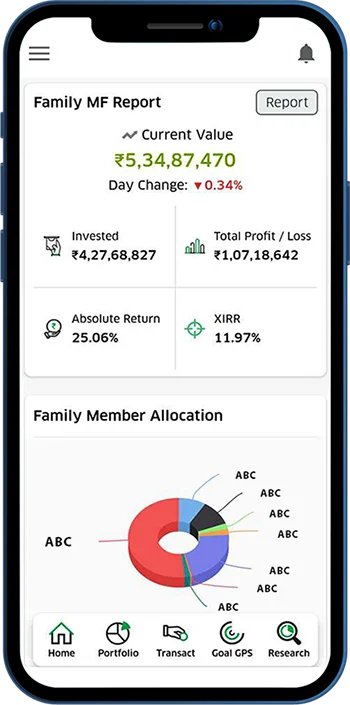

Our Digital App revolutionizes the way you manage your finances by providing a seamless and intuitive platform accessible anytime, anywhere.

We are a Fintech Startup and a SEBI registered Investment Advisor.

SEBI Registered Investment Advisor No

AMFI Member Code

BSE Star MF Member Code

One needs a large sum to invest in mutual funds |

"A prevalent myth is that a substantial amount of capital is required to begin investing. However, this is not the case; one can start with a modest sum,” individuals can invest in mutual funds with as little as Rs 500 by signing up with any of the new-age online platforms.” |

|---|---|

One needs to be an expert in equities to invest in mutual funds |

One doesn’t have to be an expert in equities to be able to make the most of investing in mutual funds. Mutual funds are managed by expert fund managers who make decisions based on the mandate of the fund, market movement, and their expertise all to maximise returns for their investors. |

One should only invest in mutual funds for the long term |

There are several mutual funds available in the market designed with all sorts of timeframes in mind. A mutual fund can be used to for long as well as short terms —it all depends on the investor’s goals, say experts. |

Guaranteed return |

This is quite a common myth, and a risky one. "While mutual funds tend to provide stable returns, they in no way guarantee returns as the underlying assets do not provide guaranteed returns," Finsify. |

One needs a Demat account to invest in mutual funds |

nvestors do not need to hold their mutual fund units in Demat form, except with respect to exchange-traded funds (ETFs), according to the Association of Mutual Funds in India (AMFI), the nodal association of mutual funds in the country that provides data and insights on investments in mutual funds. |

Higher past returns ensure future achievement |

You may have heard the following while exploring the world of mutual funds: “Past performance is no guarantee of future results.” Investors higher past returns do not ensure future achievement as market conditions change, and verifiable execution may not be demonstrative of future outcomes, explains CA and independent startup advisor Manas Gandhi. |

Mutual funds invest solely in stocks |

Finsify highlights that mutual funds don"t just invest in equities but offer a diverse range of investment opportunities, including debts and various other financial instruments. |

Mutual funds are not meant for young investors |

Early investment helps young investors build wealth over a long period of time and inculcate a habit of saving and investing, hence mutual funds are not for young investors is nothing but a myth, say Finsify. |

Actively managed funds beat passive ones |

Studies reveal that in due course of time, many effectively managed funds fail to meet the expectations of their passive counterparts because of higher expenses, points out CA Manas. |

The lower the net asset value (NAV) the better |

“NAV is a function of the valuation of all underlying stocks. So, whether the NAV is low or high, it won"t give any insight into whether the fund is good or bad,” explains Ashwani, Head-Investment Products and Insights at Finsify Services. |

Definitely We are leading the conversations on all social media. Here are some of them.

Top Features We Provide

You can download the complete portfolio report including mutual funds & other assets. Get the historical performance of your portfolio easily & track the portfolio at your fingertips.

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

Invest in well researched cherry-picked perfectly balanced portfolio.

Find answers to common questions that you may have in your mind.

Financial Planning is the comprehensive evaluation of your current financial position and future goals to chalk-out a time-bound strategy for the future. It involves assessing your financial position, identifying leakages, acknowledging your goals, assessing your risk profile, designing a suitable asset allocation plan and laying down a strategy timeline to accomplish the goals.

Financial planning involves the following steps:

A comprehensive financial plan takes all your financial attributes into account and provides an unbiased strategy that suits you. This includes everything from spending management to debt diagnosis, insurance planning, retirement planning, asset allocation and all other tools that facilitate financial freedom.

The best financial planner is one that not only studies you but understands you. Scanning your profile and suggesting you a popular investment option (yes yes, that one) is easy, but understanding your profile and recommending unpopular hacks that are perfect for you is what separates the best from the rest. Guess what? Recipe is here to change your definition of the ‘best financial planner’.

Value Investing is an investment technique that involves filtering stocks that are trading below their intrinsic (true) value. Quest by Finology is an investing knowledge platform that provides you with close-to-reality knowledge on value investing which not only enables you to make sense but also to make money in the markets. Certification from Finology is like cherry on the cake.

Follow the guide to find the perfect path to begin your investing journey, so that you can make the most out of the market:

Mutual fund investment, by its very nature, is subject to market risks, which is why it is a tough task to select funds that deliver positive returns, let alone beating the average. While mutual fund investing seems a cakewalk, most people don’t understand what’s beyond the obvious in fund-picking. Quest by Finology introduces you to the basics of how to select the right mutual fund and what they won’t tell you about it!

Investing, in general, is very subjective. Which is a good fund depends mostly on your financial profile, goals and risk appetite. The key to good fund-picking lies in the proper assessment of one’s financial profile. That is why you should use intelligent tools available in Recipe by Finology that understands you and suggests not only good funds but also tells you the risks associated and your ideal allocation to those funds. Clever, isn’t it?

Honestly, this is a very subjective question. Firstly, you will have to figure out a strategy to manage your spendings, savings and investments at the same time. Secondly, you need to assess your profile, your goals, your risk appetite and then, find a suitable investment strategy to begin with. Too complex, right? Don’t worry, Recipe will do all of this for you!

Impressed with their financial expertise. They've made a significant difference in my investments, and their strategies have maximized my returns.

Impressed with their financial expertise, they've boosted my investments and guided me to success. I highly recommend their services.

Incredible support and guidance – they've helped me achieve financial stability and growth quickly. I'm a highly satisfied client.

These experts transformed my finances, securing my future and boosting my investments. It is a game-changer. I highly recommend them.